You won’t get ahead in any industry if you simply copy your competitors. And this is especially true in SEO & content marketing.

Competitor research for SEO is really tough because…

- Nobody truly knows what they are doing.

- Confirmation bias is the default.

- Being different has a bigger payoff than being better.

- Your competitors are probably copying you.

- And a myriad other reasons.

But – you’re probably going to do it anyway so here’s a few things I do to make it a little more useful.

*note – all images are clickable for a larger version.

Don’t Do Direct Competitor Research

I’ll concede that there are plenty of insights you can get from competitor research.

But there are also plenty of insights you can get from interviewing every potential customer for an hour.

In a world of limited time resources, you probably don’t need to do direct competitor research.

Because here’s the thing –

If you are in an industry where you can get organic traffic simply by being better – you probably won’t learn anything from your competition. You just need to focus on doing your thing.

If you are in an industry where you can *not* get organic traffic simply by being better – you probably won’t be able to act on insights from your competition. You just need to focus on doing something different.

In other words, suppose you have a really good local soccer team. And you want to develop your skills, win some matches, and build a following.

Should you go watch the local kids play? Should you spend hours watching FC Barcelona play?

No! You should run practices on the fundamentals and play lots of games!

You’ll get your best insights from audience, keyword, and topical research. When those are exhausted – or you need a new thread to follow – that’s when you should layer in competitor research.

But even then, you should never go directly to a competitor’s website and click around.

Instead, develop a standardized system so that you can pull useful insights that are less likely to have confirmation bias.

Do Competitor Research Systematically

I’ve worked with dozens of clients and I’ve seen hundreds of Google Analytics dashboards. And there’s one thing that is true across them all –

Unless you have access to their Analytics profile – you have no idea what parts or pages of a website are successful. In fact – you don’t know who is successful at all.

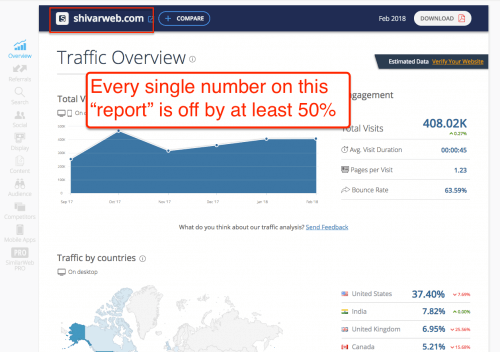

A post might have a lot of shares. The site might have a long-standing design feature. It might look like they are investing in a specific section. Ahrefs might say a certain page gets a lot of traffic. SimilarWeb might say they have a certain bounce rate.

But it’s all a guess.

So don’t go clicking around on websites.

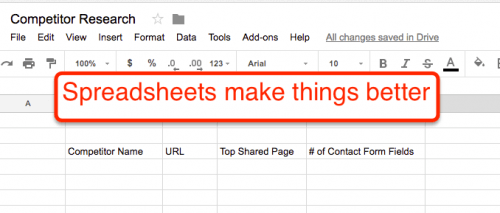

Instead, set up a spreadsheet. Gather many competitor URLs. Define what exactly you want to learn. For example –

- If you want ideas for more shares – gather share data across many URLs in addition to on-site share elements.

- If you want to reach more customers in consideration mode – scrape & categorize competitor pages and look for opportunities.

- If you want to explain your product or service better – gather copy & taglines across several competitors and analyze.

Now, you still won’t be doing true data analysis but simply having an objective and a system will allow you to save time and see the broader picture.

Since you’ll be able to pull insights quickly from multiple sources in a dispassionate format, you’ll increase the odds that you’ll find something that works on your own site.

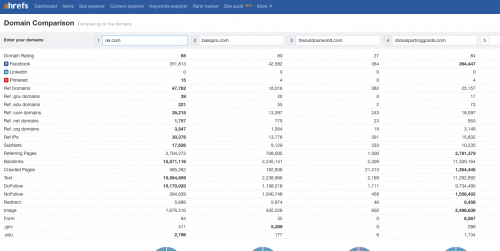

If you have good software like Ahrefs or Majestic – you can do this even faster.

Do Research on Your True Competitors

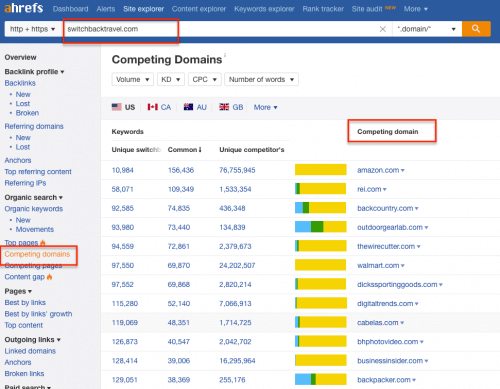

When you are gathering data for your systematic analysis, you’ll need to pull data from your true competitors in addition to your direct competitors.

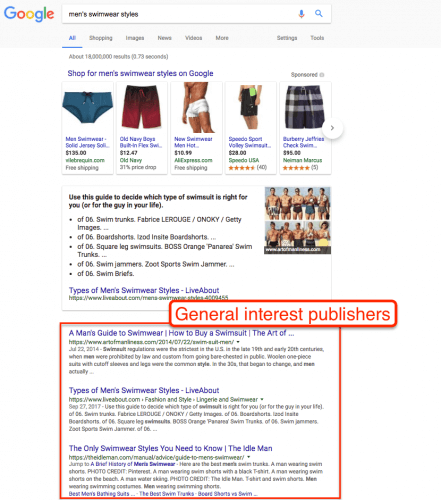

Because on the Internet, you are never competing directly with your competitor. More often, you are both competing with a thousand other websites and for your visitor’s attention in general.

For example, most SEOs know that, when judging keyword difficulty, you have to look at user intent and site type in addition to links, relevance, and authority.

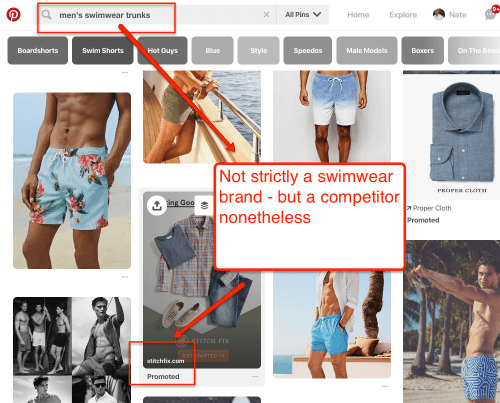

If you are a swimwear brand – you might find yourself competing more with big discounters, publishers, and Pinterest more than your rival.

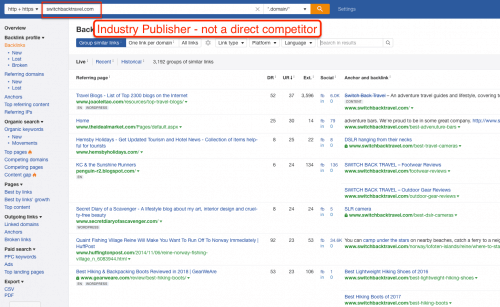

When I’m doing competitor research for myself or a client – I’ll go ahead and include top industry publishers, news outlets, and forums. And if it’s eCommerce business, same with the relevant category & subcategory pages on Amazon, Target, and eBay.

And this point doesn’t stop with SERPs – it also applies to Pinterest, Facebook, Twitter and every other marketing channel. Your true competitors go beyond your direct competitors.

Be sure to include them.

Now that you have a list of true competitors systematically organized in your spreadsheet with a clear objective – what do you look for?

Sometimes an insight will be obvious. But sometimes you’ll have a case of confirmation bias (you’ll see what you want to see).

Instead, I try to look at outliers, 2nd tiers, and “intersections.”

Research Successful Content Outliers

When you are looking at competitor data – ask yourself why some competitor content is more successful than others.

What content does your competitor have that is successful…when it really should not be that successful?

Every site generates most of their traffic / shares / links off a minority of content. Figure out what is different about that unique content and make changes based on it.

For example, one of my former clients was a large industrial manufacturer. They made an industrial material called activated carbon that had a wide-range of applications. They were using their homepage to rank for that term.

But one day – that ranking completely fell off. They went from #1 to beyond the 3rd page.

Why? Searcher intent changed. Consumers were looking for activated carbon – not purchasing managers.

The entire SERP was retail listing for activated carbon…except one. It was an educational page explaining activated carbon on a direct competitor’s site. It was an outlier.

We switched the targeting from the homepage to a *really* good educational resource within a Buyer’s Guide. It was targeted to consumers in addition to purchasing managers.

The page was much better than the competitor’s accidental success – and we not only went back into the top ten – we bounced around with Amazon and Wikipedia for the #1 spot.

Find content that should not be successful, but is. Learn from it.

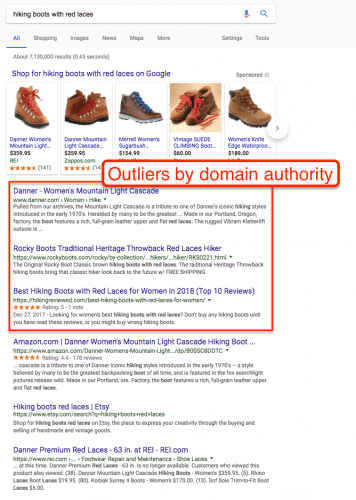

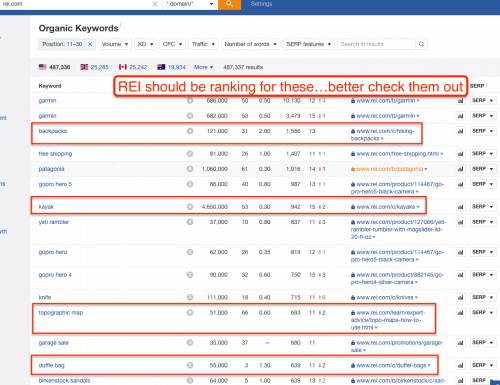

Research Failing Content Outliers

On the inverse, you should find content that should rank / get links / get shares…but doesn’t. This insight can save you a ton of work.

And again – in a world of limited time and resources, not doing a failed campaign is a success.

This angle works really well with big competitors.

For example, REI has one of the sharpest digital marketing teams on the Internet. They routinely outrank Wikipedia and Amazon. If you view them as an indirect or direct competitor – you should see which pages are not getting links / shares / rankings.

If they are explicitly targeting a query or running a campaign, and it’s not performing, then you know that there is some other variable to research.

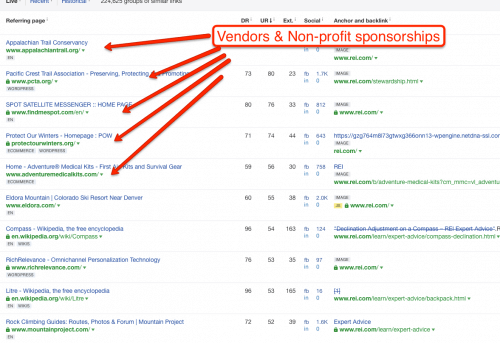

Research Successful Link & Share Types

One of the most common uses & misuses of competitor research is link & influencer stealing.

You see that Competitor A has a link from Website X. You try to get the exact same link.

Or you see Bob The Badass Influencer on Instagram promoting Competitor B. You try to get him to promote your new product.

Don’t do that.

Even if you are successful, congratulations – you’ve caught up with your competitor. But you still have to do better than them.

And if you fail, you’ve wasted time, energy, and risked your reputation on a boring me-too campaign.

There are ways to find & get competitor links – but I’ll cover that shortly.

In the meantime, use competitor research to find successful link types and influencer types.

In other words, classify your competitor’s links into categories and create outreach campaigns around that link type.

For example, suppose you compete with an online golf retailer. You find out that they have lots of links from local golf clubs and a few from local golf youth camps.

Ok – you might not get those exact same links. But you can get the same link types. In fact, you might be able to surpass your competitor because both of those link types can scale out.

The same goes for influencers. Classify the influencers into “types” – and go get your own influencers of that type.

Research 2nd Tier Links & Shares

Now – a common problem in competitor research is that the same sites and influencers come up again and again.

You need to go deeper.

The best lines of research I’ve found are:

First – Find competitor’s referring domains. Take those referring domains and look at their competing domains. Mine those for general opportunities.

Second – Find competitor’s competing pages. Take those pages and look at their backlinks. Mine those for specific opportunities.

The principle here is to use your competitor as a jumping off point to cast a wide net for link opportunities.

You can do the same with social shares – especially on Pinterest and Twitter.

Research Customer Language & Feedback

Sometimes the best competitor research is tedious, manual work. Remember that the higher the barrier to entry – the better advantage you’ll have.

If your competitor operates in a public fashion at all – or if they are large enough to have brand name products, then there is customer feedback and reviews littered everywhere on the Internet.

The opportunity for you is to find it, read it, analyze it, and make the most of competitor research. There’s no easy way to do this. But you should make heavy use of Google Search Operators in addition to Q&A platforms like Quora, Reddit, and Amazon.

ConversionXL also has further reading on this approach.

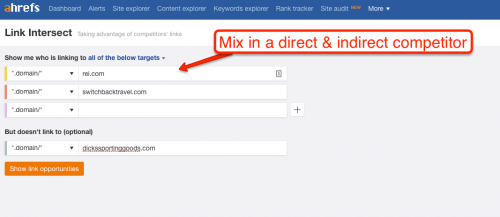

Intersect Direct Competitors with True Competitors

Remember when I said not to try to get your competitor’s links?

Here’s the caveat – you should try to get links that show up in a “Link Intersect” report.

You might not find a lot – but they’ll usually be quick wins.

This process means taking two or more competitors, running them through a link intersect tool and getting the links that look interesting.

A twist to find higher-quality links – intersect direct competitors with “True Competitors” like Amazon, industry publishers, and other SERP competitors.

A note – be sure to filter out bad links. If a link looks sketchy or “off” – be sure to avoid it. It’s either a paid link or a PBN link. It’ll eventually come back to haunt your competitor.

Next Steps

Doing competitor research for SEO & content marketing is a necessary evil. Focus on what makes you unique. Focus on your target audience.

But once competitor research makes sense, do it in a systematic way with clear objectives. Take what objectively works and go back to being different.

Be sure to explore the full list of Free Tools To Find Prequalified Content Ideas!